UK government borrowing hits highest January level since records began

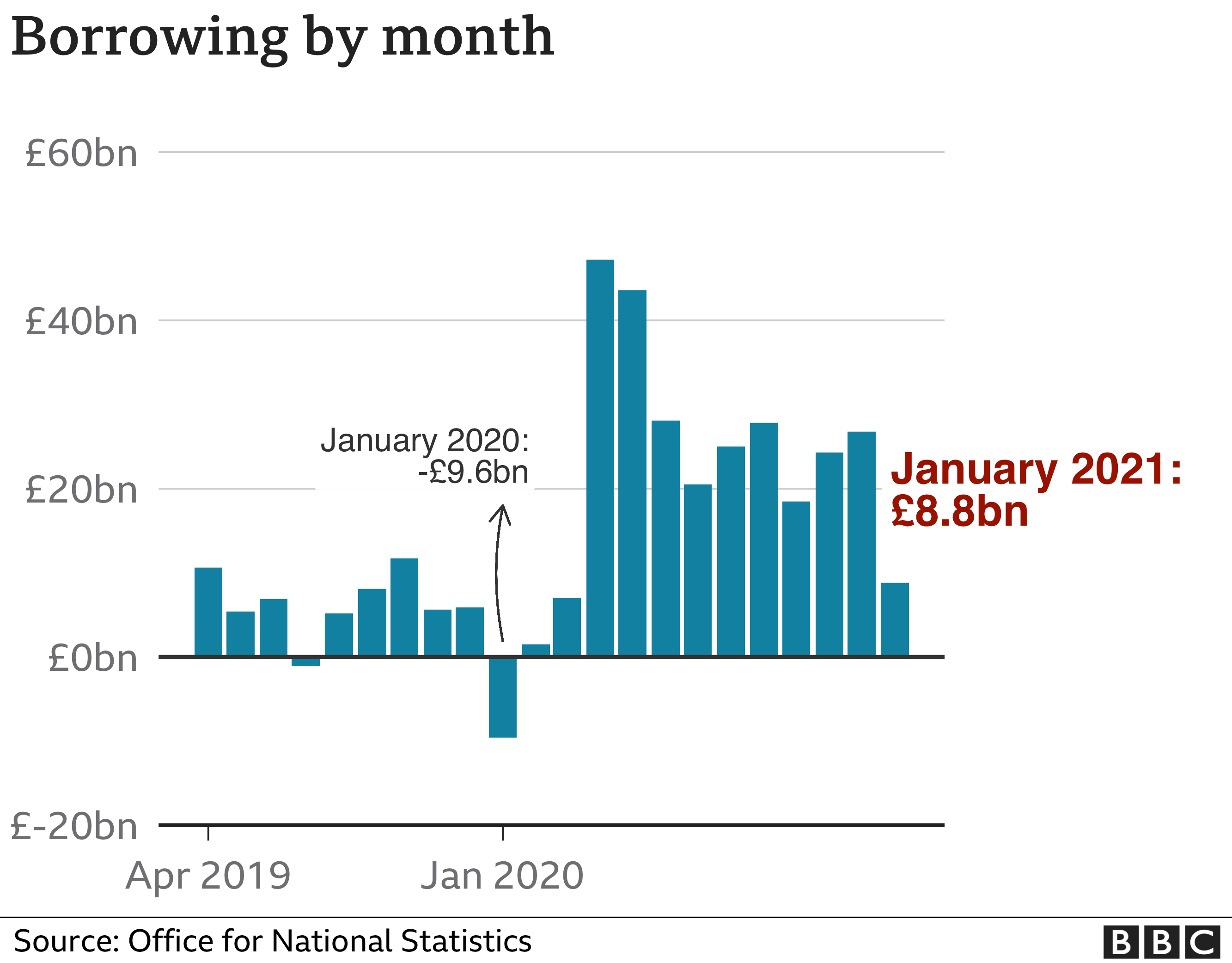

UK government borrowing hit £8.8bn last month, the highest January figure since records began in 1993, reflecting the cost of pandemic support measures.

It was the first time in 10 years that more has been borrowed in January than collected through tax and other income.

January is usually a key revenue-raising month as it is when taxpayers submit their self-assessment returns.

Tax income fell by less than £1bn, but the government spent £19.7bn more than last year on measures such as furlough.

Government borrowing for this financial year has now reached £270.6bn, which is £222bn more than a year ago, said the Office for National Statistics (ONS), which published the data.

The independent Office for Budget Responsibility (OBR) has estimated that borrowing could reach £393.5bn by the end of the financial year in March.

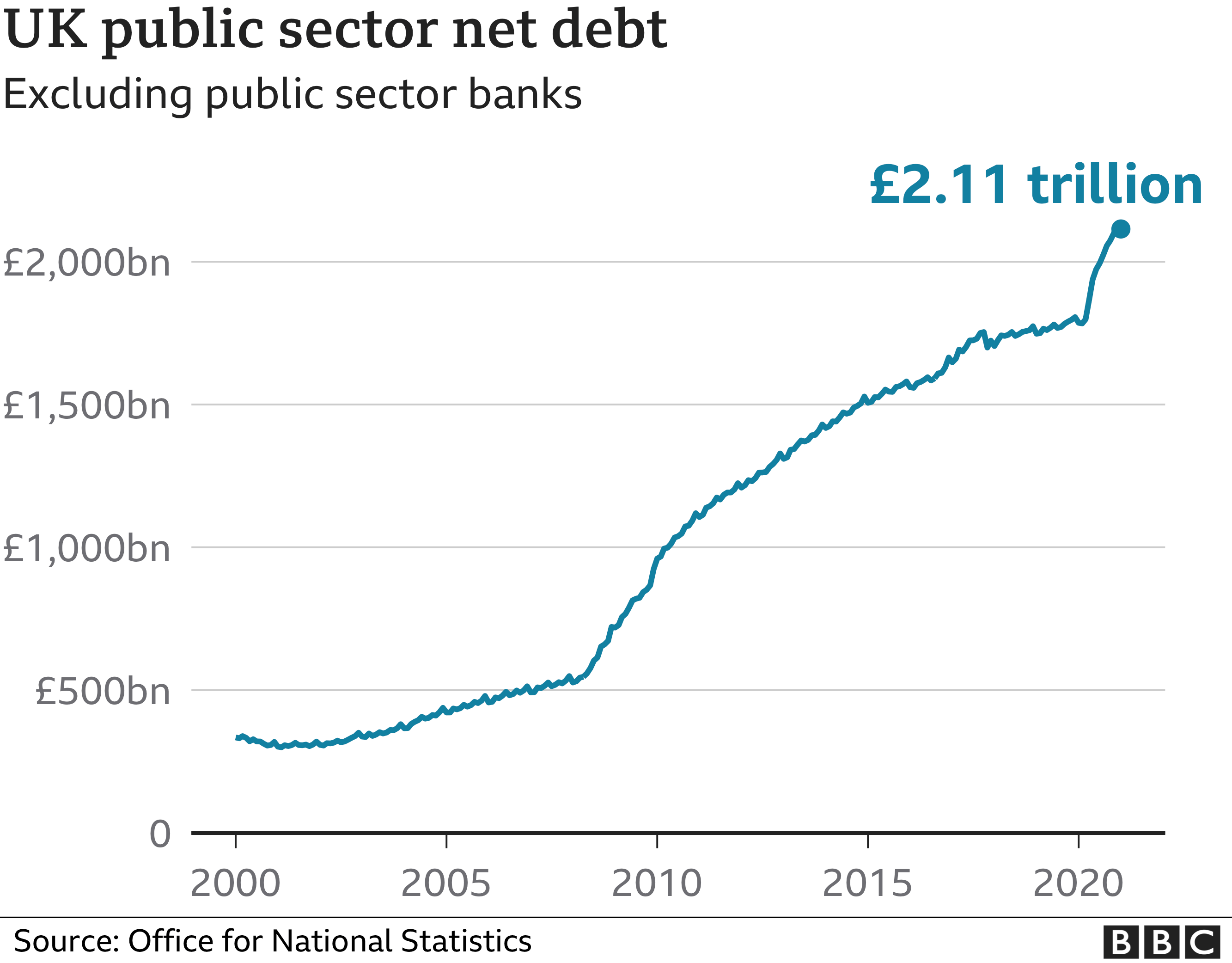

The increase in borrowing has led to a steep increase in the national debt, which now stands at £2.11 trillion.

The UK’s overall debt has now reached 97.6% of gross domestic product (GDP) – a level not seen since the early 1960s.

The ONS warned that although the impact of the pandemic on the public finances is becoming clearer, “its effects are not fully captured” in the current data, and that its estimates of tax receipts and borrowing are “subject to greater than usual uncertainty”.

Hospitality companies have been excused from paying business rates and home buyers have had a break from paying stamp duty since July. Both these factors meant a drop in revenue for the government.

But alcohol duty has risen by a quarter and self-assessed income tax receipts were £1.4bn higher.

Overall, tax income fell about 1% to £80.3bn.

Some of the self-assessed income tax gain probably came from the government’s policy of allowing some later payments that were due from July, the ONS noted.

In the 10 months to January, self-assessed income tax receipts were £26.3bn, £2bn less than in the same period a year earlier.

Published at Fri, 19 Feb 2021 08:04:44 +0000

Comments

Loading…