Rishi Sunak extends furlough scheme for another month

Getty Images

Chancellor Rishi Sunak has extended the furlough scheme for one month until the end of April next year.

He said the move would provide “certainty for millions of jobs and businesses”.

It means the government will continue to pay up to 80% of the wages of workers who have been furloughed.

Mr Sunak also confirmed he would be extending the government-guaranteed Covid-19 business loan schemes until the end of March.

These changes come in the run-up to the next Budget, which the chancellor confirmed would take place on 3 March 2021.

The roll-out of vaccinations has provided hope for businesses struggling to get through a winter of stop-start measures to control the virus. But it is likely to be several months before enough of the population has been covered to allow for anything like business as usual.

“Our package of support for businesses and workers continues to be one of the most generous and effective in the world – helping our economy to recover and protecting livelihoods across the country,” Mr Sunak said.

“We know the premium businesses place on certainty, so it is right that we enable them to plan ahead regardless of the path the virus takes, which is why we’re providing certainty and clarity by extending this support.”

The move drew criticism from the opposition. Shadow chancellor Anneliese Dodds said Mr Sunak had “waited until the last possible minute to act, leaving businesses in the dark with less than 24 hours before they have to issue redundancy notices”.

She added: “Rishi Sunak’s irresponsible, last-minute decision-making has left the UK with the worst recession of any major economy.”

But CBI chief economist Rain Newton-Smith said the package would “bring some much-needed certainty and respite” for businesses.

“Stable employer contributions and an extension to the Job Retention Scheme until the end of April will mean the scheme continues to protect people’s livelihoods,” she added.

“And with cashflow difficulties still at the forefront of the minds of many business owners, continued access to government-backed loans through to spring will bring great comfort.”

Criteria unchanged

The government will continue to pay up to 80% of the salary of employees for hours not worked until the end of April, with a cap of £2,500 a month.

Employers will only be required to pay the wages, National Insurance (NI) contributions and pensions for hours worked, as well as NI contributions and pensions for hours not worked.

The eligibility criteria for the UK-wide scheme will remain unchanged and these changes will continue to apply to all devolved administrations, the government said.

The extension of the furlough scheme into April will help some firms – but only to pay wages. Firms urgently need further cash to pay rent, suppliers and energy bills. The Bank of England estimated last week that the private sector as a whole has £180bn less cash coming in this financial year than it needs to cover costs.

Extending availability of emergency loans by two months may help ease that huge squeeze on cash flow. But it’s not clear more debt is the answer. The National Audit Office has estimated that up to £26bn of the £43bn lent in Bounce Back Loans may not be paid back.

There’s now growing pressure to offer much more in grants, not loans, to stop a bleak Christmas ruining thousands of normally healthy businesses in the new year.

The risk is stark: if you ban two-thirds of the country from meeting anyone from another household indoors eight days before Christmas, tens of thousands of pubs, restaurants and hotels could go under.

The furlough scheme is officially known as the Coronavirus Job Retention Scheme.

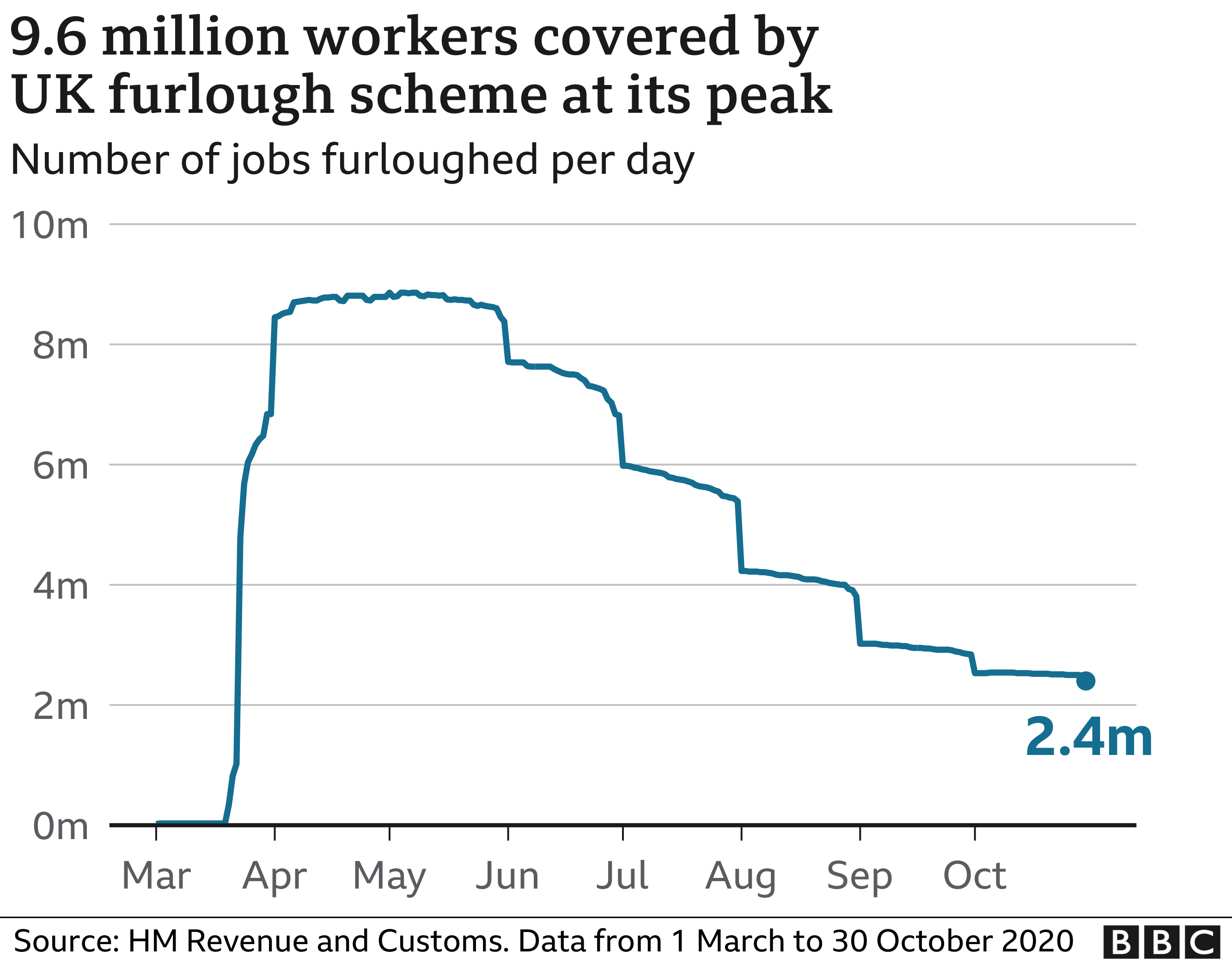

So far, it has supported 9.6 million jobs across the UK, with more than one million businesses using it.

Businesses will also have until the end of March to access the Bounce Back Loan Scheme, Coronavirus Business Interruption Loan Scheme, and the Coronavirus Large Business Interruption Loan Scheme.

These had been due to close at the end of January.

To date, they have already provided more than £68bn in guaranteed loans to firms.

Hospitality, leisure and retail providers have been particularly severely affected by months of changing regulations, sharply reducing their revenues.

On Thursday, Health Secretary Matt Hancock announced more parts of south-eastern England would move into tier three, the strictest level of measures. London was moved to tier three on Wednesday.

Published at Thu, 17 Dec 2020 16:16:11 +0000

Comments

Loading…