food companies must innovate and invest – Crain’s Chicago Business

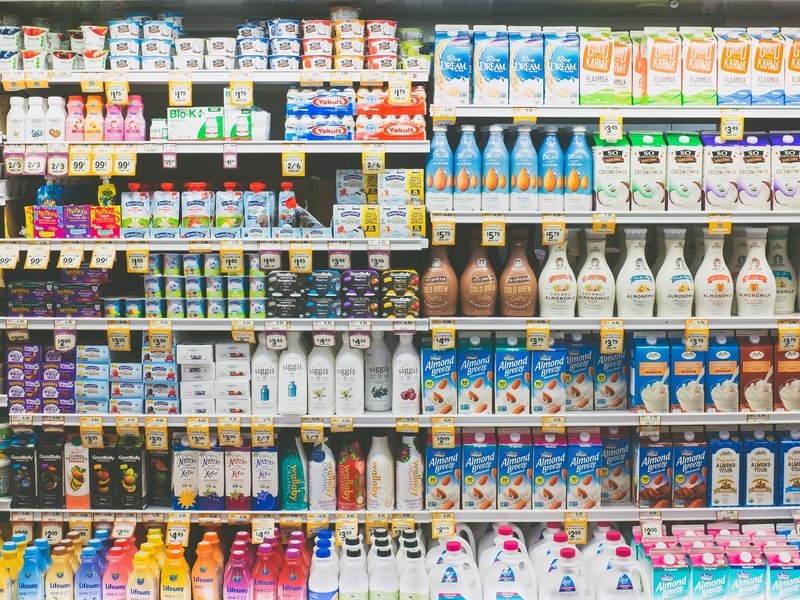

The big story in packaged foods this year has been the rediscovery of familiar old brands by consumers forced to eat more meals at home.

Comfort-food stockpiling during the pandemic is boosting Chicago’s giant food companies, which specialize in shelf-stable standbys of yesteryear. After years of struggling to generate growth, companies like Kraft Heinz, Mondelez and ConAgra are scrambling to churn out enough Kraft Macaroni & Cheese, Oreo cookies and Birdseye frozen vegetables to meet demand.

Comforting as the comfort-food binge may be, it won’t secure Chicago’s place as a center of food production in decades to come. Far more relevant to the region’s future in packaged foods is another COVID-fueled trend that’s gotten less attention.

As my colleague Ally Marotti reported in Crain’s this week, changing consumption patterns amid the pandemic have sparked a wave of innovation and entrepreneurship in packaged foods. Nimble startups, not plodding behemoths, are leading the industry forward with new products tailored to the times.

To keep pace, Chicago needs to shake its dependence on massive 20th-century food companies and nurture a food startup culture on par with the technology hotbeds of Silicon Valley. Encouragingly, local food entrepreneurship is surging this year. The number of food and beverage companies in Illinois jumped to 373 from 84 in 2020, according to PitchBook. Chicago-area food and beverage startups raised $216 million in venture funding so far this year, nearly triple the 2019 total, Crunchbase reports.

Impressive as those numbers look, Chicago still lags well behind many of the same places that outpaced us in other entrepreneurial sectors. Chicago’s food industry venture funding this year pales beside tech hub San Francisco’s $2.7 billion, New York’s $706 million, Los Angeles’ $630 million and Boston’s $536 million.

None of those cities can match Chicago’s history in food. We’ve been feeding the country since the Swifts and Armours industrialized meat packing and distribution in the 19th Century. Over the next century, local companies like Quaker Oats, Kraft and Sara Lee modernized food packaging and marketing.

Some of those companies are gone and some remain. Though their legacy doesn’t ensure future dominance, it has created a deep reservoir of expertise, insight and industry knowledge. Those are the ingredients of successful entrepreneurship.

If Chicago should dominate innovation in any industry, food is the one. And food is an industry worth dominating. It’s enormous—sales in U.S. grocery stores alone exceeded $680 billion last year. And it’s relatively immune to economic downturns—people have to eat in good times and bad.

The downside: Packaged food is a mature industry that grows slower than sectors like technology. Growth struggles have sparked consolidation, creating enormous companies like Kraft Heinz and Mondelez. Still, they lost ground in the marketplace; Credit Suisse reports that the 20 largest packaged food companies ceded five percentage points of market share to startups and others between 2011 and 2013.

Publicly-traded food giants face pressure to support their share prices by delivering consistent earnings per share increases. With little or no revenue growth, the only way to lift EPS is by slashing expenses to expand profit margins. That means job cuts.

Real growth is found on the industry’s entrepreneurial cutting edge, where young companies with fresh ideas are winning customers and adding jobs. Chicago-based Simple Mills, for example, hired 28 workers this year as the rise of at-home baking during the pandemic sparked demand for its gluten-free baking mixes. Another local startup, Evergreen, scored a hit with healthier frozen waffles that are now available in 46 Whole Foods stores.

The beginnings of a thriving food innovation ecosystem are starting to take shape in Chicago. A startup incubator called the Hatchery opened on the west side to nurture fledgling food companies. And a couple of local venture investors—former McDonald’s CEO Don Thompson and Walmart heir Lukas Walton—are focusing on food startups.

Plentiful sources of early-stage investment capital are essential to cultivating new food companies. But investors look to cash out eventually, sometimes in the kind of deals that can stunt the local industry’s growth. We’ve seen it in technology, where Chicago’s most-promising startups often accept buyout offers from bigger firms based elsewhere. Some flourish under out-of-town ownership, but others lose autonomy and jobs along with their independence.

Signs of a similar pattern are emerging in food. Outside acquirers have snapped up some successful Chicago-area food startups in recent years. Batavia-based meal delivery service Factor75 agreed last month to a $277 million acquisition by larger rival HelloFresh. Grocery giant Kroger paid $200 million for Chicago-based meal kit maker Home Chef two years ago. Chicago-based protein bar maker RXBar sold to cereal maker Kellogg for $600 million in 2017.

Acquisitions reward company founders and their investors with rich paydays. Hopefully, some of that money and talent is recycled into new Chicago-area food startups. But Chicago won’t reach its full potential as a 21st century food power if its COVID-era startup crop becomes buyout fodder.

Published at Tue, 08 Dec 2020 21:15:53 +0000

Comments

Loading…