‘Fiscal guardrails’ shrouded in fog as net federal debt to pass $1-trillion mark

Finance Minister Chrystia Freeland, seen here during a news conference in Ottawa on Nov. 30, 2020, pointed to ‘fiscal guardrails’ as a way to be transparent with Canadians. Adrian Wyld/The Canadian Press

Ottawa is pledging to use “fiscal guardrails” to determine when it will wind down its stimulus program and end the extraordinary flood of spending that will send the net federal debt soaring far past the $1-trillion mark.

As part of Monday’s fall economic update, Finance Minister Chrystia Freeland pointed to that approach as a way to be transparent with Canadians, saying the government will use “data-driven triggers” focused on the jobs market: the employment rate, the unemployment rate and, “crucially,” total hours worked.

But those fiscal guardrails are shrouded in fog, leaving Canadians with little insight as to when the federal government might deem the economy sufficiently recovered that it will turn its attention to reducing spending to sustainable levels. What level of employment, what unemployment rate, what number of hours worked will trigger a retrenchment of spending?

Ms. Freeland isn’t saying. “We’re going to roll those out when we roll out more details of our growth plan,” she said when pressed by reporters for specifics.

Liberals plan $100-billion in new stimulus spending, begin plotting pandemic recovery

Ottawa vows tailored financial support for hardest-hit sectors

The timing of the reintroduction of fiscal anchors, a public promise to place limits on spending, is similarly up in the air. Right now, the only commitment from Ms. Freeland is to reintroduce a fiscal anchor “when the economy is more stable.”

Until July, fiscal anchors had been the keystone of federal budgets for three decades. Ms. Freeland’s predecessor, Bill Morneau, scrapped the government’s anchor of a declining ratio of debt to gross domestic product in his limited fiscal update that month. The surge in pandemic spending made that move a foregone conclusion. He had hinted that the government would reintroduce a new measure this fall, but Ms. Freeland is now promising only that the Liberals will recommit themselves to fiscal limits at some indeterminate point in the future.

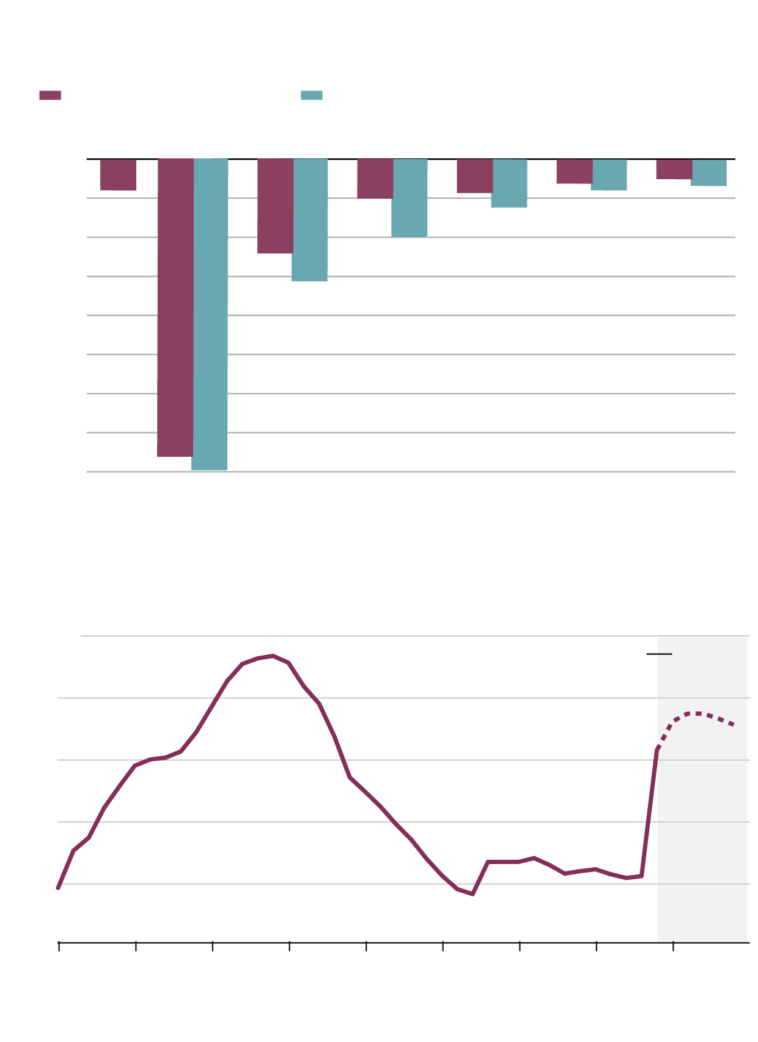

The five-year projections in the economic update appear to give some assurances on that front, with the deficit projected to fall to $121.5-billion in fiscal 2021-22, declining to just $24.9-billion in 2025-26. That would leave the deficit lower than its prepandemic levels. The debt-to-GDP ratio would peak at 52.6 per cent in 2021-22, falling gradually to 49.6 per cent over the next four years.

revenue and expenses breakdown

April-Sept. 2020

$327-billion

$7.7: Net actuarial

losses

$12.3: SAR (Safe

Restart Agreement)

$6.3: CEBA 25%

incentive

$44.1: CEWS

$66.5: CERB

$10.4: Public debt

charges

$45.7: Major transfers

to other levels of gov’t,

excl. Safe Restart

Agreement

$128.8-billion

$1.6: Other

revenues

$19.0: Excise

taxes and

duties

$81.8: Direct program

expenses, excl. CEWS

and 25% incentive

$18.6: Corp.

income taxes

$10.9: EI

premiums

$55.2: Major transfers

to persons, excl.

CERB

$78.8: Pers.

income tax

CEWS: Canada Emergency Wage Subsidy; CERB: Canada Emerency

Response Benefit; CEBA: Canada Emergency Business Account

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: department

of finance canada

revenue and expenses breakdown

April-Sept. 2020

$327-billion

$7.7: Net actuarial

losses

$12.3: SAR (Safe

Restart Agreement)

$6.3: CEBA 25%

incentive

$44.1: CEWS

$66.5: CERB

$10.4: Public debt

charges

$45.7: Major transfers

to other levels of gov’t,

excl. Safe Restart

Agreement

$128.8-billion

$1.6: Other

revenues

$19.0: Excise

taxes and

duties

$81.8: Direct program

expenses, excl. CEWS

and 25% incentive

$18.6: Corp.

income taxes

$10.9: EI

premiums

$55.2: Major transfers

to persons, excl.

CERB

$78.8: Personal

income tax

CEWS: Canada Emergency Wage Subsidy; CERB: Canada Emerency

Response Benefit; CEBA: Canada Emergency Business Account

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: department

of finance canada

revenue and expenses breakdown

April-Sept. 2020

$327-billion

$7.7: Net actuarial

losses

$12.3: SAR (Safe

Restart Agreement)

$6.3: CEBA 25%

incentive

$44.1: CEWS

$66.5: CERB

$10.4: Public debt

charges

$45.7: Major transfers

to other levels of gov’t,

excl. Safe Restart

Agreement

$128.8-billion

$1.6: Other

revenues

$19.0: Excise

taxes and

duties

$81.8: Direct program

expenses, excl. CEWS

and 25% incentive

$18.6: Corp.

income taxes

$10.9: EI

premiums

$55.2: Major transfers

to persons, excl.

CERB

$78.8: Personal

income tax

CEWS: Canada Emergency Wage Subsidy; CERB: Canada Emerency Response Benefit;

CEBA: Canada Emergency Business Account

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: department

of finance canada

But that picture of modest fiscal discipline doesn’t include the government’s three-year plan to spend between $70-billion and $100-billion on economic stimulus. Nor does it take into account the costs of some of the broad promises of the fall’s Throne Speech, including a pharmacare program and what could be a costly venture into an expanded federal role in child care. It also excludes billions in potential added costs from revisions to the formula for calculating fiscal stabilization payments to the provinces announced as part of Monday’s economic update.

The government provided some scenarios that wrapped in the costs of its stimulus program, along with more pessimistic assumptions on the virulence of the coronavirus this winter, and the resulting economic and fiscal damage. That is part of what Ms. Freeland says is the government’s effort to be “transparent about the continuing uncertainty.”

The projection of a $50.7-billion deficit in 2022-23 nearly doubles, to $99.6-billion, in the scenario of only a slight worsening of the coronavirus and a $70-billion price tag for the three-year stimulus spending. In that forecast, the debt-to-GDP ratio peaks at 57.3 per cent before declining to 55.5 per cent in 2025-26.

federal budget deficits

Including second wave impact, fiscal year, $ billions

Including worsening pandemic

and $70-billion in stimulus spending

Budget deficits–

2020 update

2019-

2020

2020-

2021

2021-

2022

2022-

2023

2023-

2024

2024-

2025

2025-

2026

historical federal debt as percentage of gdp

End of fiscal year, 1982-2026

Includes

stimulus

spending

as shown

in first

chart

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: Department

of Finance Canada; statscan

federal budget deficits

Including second wave impact, fiscal year, $ billions

Including worsening pandemic

and $70-billion in stimulus spending

Budget deficits–

2020 update

2019-

2020

2020-

2021

2021-

2022

2022-

2023

2023-

2024

2024-

2025

2025-

2026

historical federal debt as percentage of gdp

End of fiscal year, 1982-2026

Includes

stimulus

spending

as shown

in first

chart

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: Department

of Finance Canada; statscan

federal budget deficits

Including second wave impact, fiscal year, $ billions

Including worsening pandemic

and $70-billion in stimulus spending

Budget deficits–

2020 update

2019-

2020

2020-

2021

2021-

2022

2022-

2023

2023-

2024

2024-

2025

2025-

2026

historical federal debt as percentage of gdp

End of fiscal year, 1982-2026

Includes

stimulus

spending

as shown

in first

chart

JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: Department of Finance

Canada statscan

And, deficits are much larger in the worst case, with a resurgent virus and a $100-billion stimulus program. Again, those projections do not include costs such as increased fiscal stabilization payments or new federal child care spending.

“It’s a very confusing picture,” says Alexandre Laurin, director of research at the C.D. Howe Institute. He noted that Monday’s update provided more clarity than the July more-limited update, which provided projections only for the current fiscal year.

But the fiscal outlook is still cloudy, Mr. Laurin said, pointing to major looming expenditures that don’t appear in the update. Mr. Laurin said the spending priorities laid out in the Throne Speech would be costly, between $19-billion and $44-billion a year, depending on the breadth of the Liberals’ ambitions.

That would put federal finances on a much different track than the gradually declining debt depicted in the outlook. Instead, big increases in program spending would cement in place large deficits, leaving debt rising relative to the Canadian economy – and federal finances increasingly precarious.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

Published at Tue, 01 Dec 2020 02:02:01 +0000

Comments

Loading…