How to Invest in Penny Stocks: The Do’s and Don’ts of Nano-Stock Investing

Penny stocks are some of the most deceptively dangerous types of stocks on the market. If you play them right, they can add a nice chunk of change to your portfolio. If you get over-zealous, though, penny stocks can tank your entire financial future in the blink of an eye.

This guide will take you through what you need to know about investing in penny stocks if you decide that investing in micro- or nano-cap assets is something you want to try. However, nano-stock investments should never comprise a significant percentage of your financial portfolio. Many, if not most, successful investors build their wealth without any penny stock investments whatsoever, so these are certainly not essential to your future financial success.

What Are Penny Stocks?

Penny stocks are low-cost shares of small companies that typically trade below a dollar or two per share. You may also see them referred to as micro-cap stocks, nano-cap stocks, or small-cap stocks. The Securities & Exchange Commission recently changed the official definition of a penny stock to anything trading below $5, but most penny stocks are considerably cheaper.

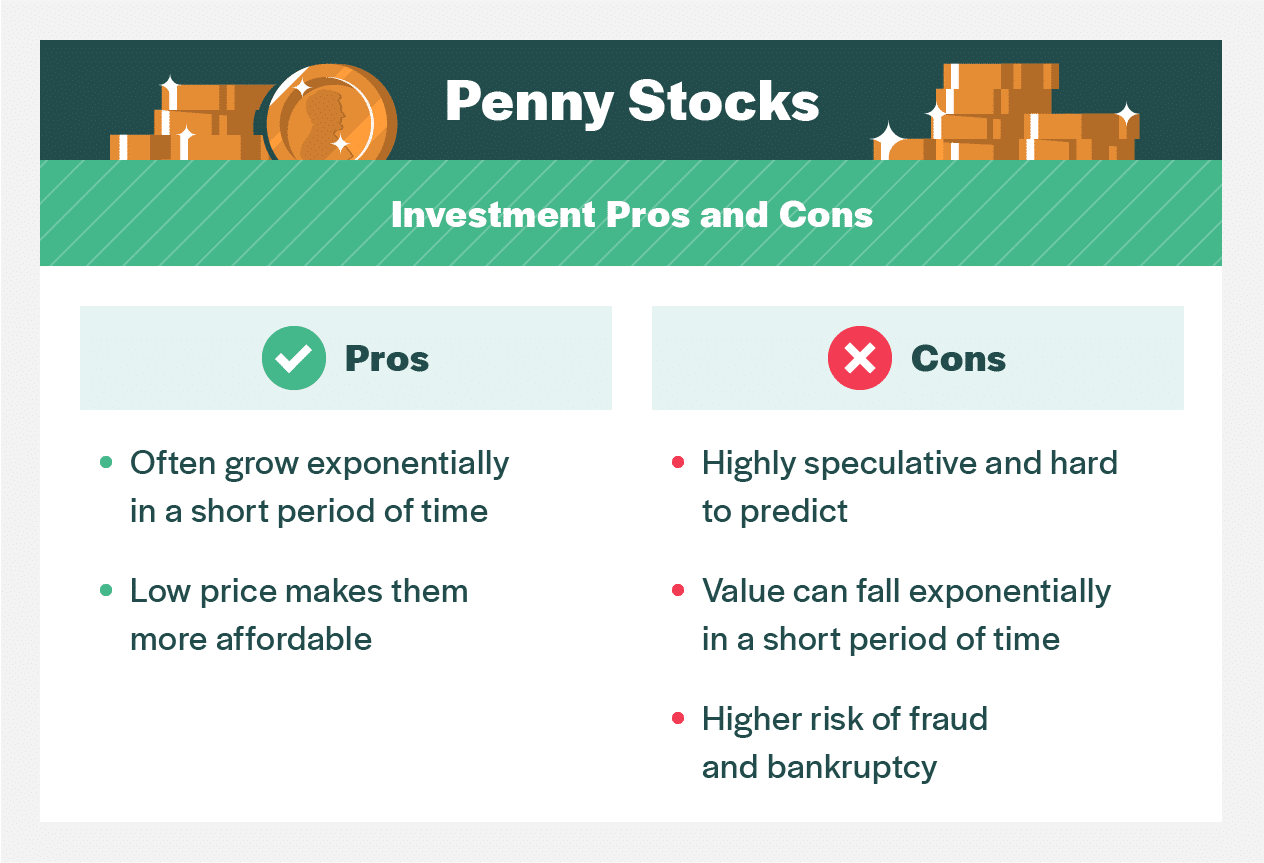

Penny Stock Pros and Cons

Penny stocks are usually shares of small- or micro-cap companies. Companies with smaller market capitalization tend to have lower liquidity and a smaller pool of interested investors, so they trade less frequently and are harder to predict. Since penny stocks behave so much differently from other stocks, they have their own unique set of benefits and drawbacks.

Pro: High Potential

It’s common for penny stocks to fluctuate by a few cents or more each day. A 5-cent increase might not seem like much, but if the original stock price was also 5 cents, that’s a 200% increase in a single day. For investors who can afford to take big risks, the potential for major value increases like these can be tempting.

Another reason penny stocks can be appealing is that market capitalization will grow if a company takes off. If this happens, a penny stock can become a mid- or even large-cap stock in as little as a few months. An example of a penny stock that skyrocketed is Snap Inc. (NYSE:SNAP), which was trading just below $5 at the end of 2018 and, within two years, had broken $50 per share.

With their potential for meteoric growth, penny stocks represent a fortune-hunter’s dream. But for the smart investor, that’s exactly what they are: a dream.

Con: High Risk

The reason smart investors don’t place a lot of stock (literally) in nano-cap companies? Simple: penny stocks can skyrocket, but they can also lose value just as quickly. A big swing on a nano-cap investment can result in a catastrophic miss. Someone who invests a large amount in 5-cent stock can either double their investment or lose it all with a fluctuation of just 5 cents up or down over the course of a day.

What’s more, small- and micro-cap companies are often in the earlier stages of business. As a result, they’re more likely to fail than larger, more stable companies. Buy-and-hold isn’t necessarily a surefire strategy in the penny stock game because your investment can disappear completely if the company folds.

How to Pick Penny Stocks

As long as you’re putting the necessary stops and limits in place, trading penny stocks can be a fun way to experiment with investing in unconventional companies. Here’s how to do it wisely.

Find a Good Stock Screener

Your first step is to find a stock screener you like that allows you to sort stocks by several different factors, such as share price, price-to-earnings ratio, market capitalization, and other relevant characteristics. TradingView, Yahoo Finance, and Google Finance offer great stock screening tools for free. If you’re looking for something a little more robust, Trade Ideas is a great option.

Screen for Penny Stock Characteristics

Using your stock screener’s built-in search filters, narrow your search to prospective penny stock opportunities. The two primary penny stock characteristics are a share price below $5 and a market capitalization of less than $300 million.

Another filter that can help identify high-potential penny stocks is the price-to-earnings ratio. Screen for stocks with a P/E ratio of less than 1 to identify stocks whose earnings per share are greater than the cost per share. This indicates that the company’s business model is profitable and likely to attract more investors, which will drive up share prices.

Do Your Research

Once you have a list of penny stocks you think you may be interested in buying, research the companies behind them to learn a few key pieces of information. Are they profitable or projected to become profitable in the near future? Is there a market for growth in their industry?

You should also determine whether the company has any plans to dilute share prices via stock splits or new share issuances. The more shares are issued, the lower the value of existing shares becomes.

Make Your Picks

Once you feel confident you’ve done your due diligence and found a promising stock, it’s time to place your order. You can use the brokerage platform you normally trade with, but be careful — some platforms leverage high surcharges for penny stock transactions, which can add up quickly.

It’s also smart to use stop limits and activation prices when trading penny stocks because prices can fluctuate quickly. Stop limits ensure your order won’t go through if the share price has risen above a certain point. Activation prices allow you to identify a price point at which you want to sell off certain shares automatically.

Final Word

The best attitude to have when investing in penny stocks is to think of them less like investments and more like lottery tickets. Though you can — and should — do plenty of research when buying micro-cap stocks, in the end, much of penny stocks’ success is determined by pure chance.

If you decide to invest in penny stocks, be sure to establish some boundaries for yourself beforehand. Give yourself strict limits on the amount you plan to invest and the number of penny stocks you’re willing to buy, and be sure never to invest so much that you throw your portfolio out of balance.

Most importantly, never make a split-second investment decision. You may see a stock you considered buying skyrocket right after you passed on it, but don’t let that be the reason you take an unnecessary risk on the next nano-stock you see. When it comes to penny stocks, patience is key.

Published at Wed, 06 Jan 2021 23:35:34 +0000

Comments

Loading…