Compass Listing Is Worth a Tour

Compass, which generates most its revenue from commissions, grew revenue by 56% last year.

Photo: Smith Collection/Gado/Getty Images

Compass, the real-estate brokerage platform that promotes itself around exclusivity, is about to open its house to public investors.

With companies such as Zillow, Redfin and Opendoor already publicly traded, there are many ways to invest in real estate’s radical disruption. But to make a bet, you must first consider who is more valuable to a real-estate platform—the agents or the consumers.

All real-estate technology companies are looking to get as close to the transaction as possible. To get there, iBuyers, or automated home flippers, like Zillow and Opendoor will physically buy and turn the inventory themselves, attracting customers with technology that enables quick and painless digital offers for their homes.

Compass is going about things differently, luring agents with technology to make them more effective. It is even offering them equity—an alluring incentive ahead of an initial public offering likely to earn the company a market value far greater than the post-money valuation of its last private fundraising at $6.5 billion.

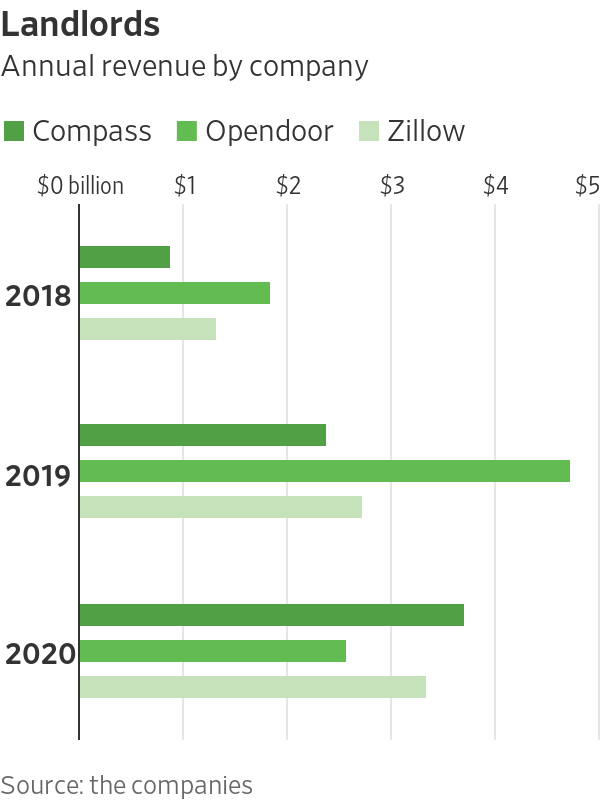

Since almost 90% of home buyers and sellers in the U.S. still work with agents, an agent-centric approach is sensible. Taking advantage of the massive increase in real-estate transactions last year, Compass, which generates most its revenue from commissions, grew revenue 56% last year. Opendoor, by comparison, said revenue fell 46% last year on the same basis as iBuyers’ automated home-flipping businesses temporarily shut down due to the coronavirus pandemic.

Though it is agent-focused, Compass isn’t neglecting consumers. It offers many listings exclusively or before they are listed more broadly on other platforms. Compass also will cover the cost of a seller’s select home repairs essentially interest free until 12 months pass or the home is sold by Compass. Its focus on luxury also targets a particularly desirable consumer base. While iBuyers have focused on markets such as Phoenix and Las Vegas, where real estate is somewhat uniform and moderately priced, Compass targets more affluent cities such as San Francisco, New York and Los Angeles.

Like Opendoor, Compass is a growth-oriented,

Softbank

-backed company. Its total transactions have grown over 500% in the past two years, representing 4% of the overall U.S. residential market by gross transaction value last year.

In a November investor presentation, Opendoor said it had about 2% market share by home transaction volume, but only in the 21 select markets in which it was then operating. However, it noted that only about 20% of those who come to its platform are “real sellers,” with the majority just looking for a quote. That at least implies Opendoor is touching many more consumers than its total transactions suggest.

If an especially competent agent is what a consumer is looking for, listing with Compass rather than an iBuyer might be worth the extra time and effort. Agents say they come to Compass for its technology, which is centralized and gives them a quantifiable edge. Compass highlights that edge in its filing, saying its agents close an average of 19% more transactions measured from their first to their second year on its platform. It also says they sold homes in 21% fewer days last year, on average, relative to agents at firms in the same cities selling comparably valued homes.

Some had outside help. Many Compass agents also advertise their business on Zillow, for example. That cross-pollination underscores a larger point in real estate disruption: There may not be a one-size-fits-all approach. Pre-pandemic, Opendoor grew revenue over 160% year over year in 2019, just shy of the growth Compass put up that year—proof that there is massive demand for real-estate digitization in many arenas.

Like in Monopoly, the trick to investing in real-estate technology companies might not be to land on the best property but to buy them all.

Write to Laura Forman at laura.forman@wsj.com

Published at Thu, 11 Mar 2021 17:30:00 +0000

Comments

Loading…