Ghana Seeks Fiscal Space With Africa’s First Zero-Coupon Bond – BNN Bloomberg

(Bloomberg) — Ghana is looking to free up cash and buy back expensive domestic debt as it taps international markets for as much as $5 billion this week, including Africa’s first zero-coupon dollar bond.

The zero-coupon debt would help the country to limit interest payments over the four-year term, interim head of the finance ministry, Charles Adu Boahen, said in a text message. Rates as high as 19% on domestic bonds makes debt-service costs “so high” in comparison with dollar debt, said Boahen, who is in the role while Minister of Finance-designate Ken Ofori-Atta completes parliamentary vetting procedures.

The average weighted interest rate on the country’s domestic debt stood at 17.2% at the end of 2020 compared with 5.3% for external debt, according to the finance ministry. Ghana’s interest expense as a share of revenue is expected to top 50% this year, compared with a median of 11% for similar-rated sovereigns, Fitch Ratings said this month.

“Given our elevated debt levels and interest expense due to Covid-19, it seemed like a good time to create fiscal space and to drive domestic interest rates down by reducing demand locally,” Boahen said.

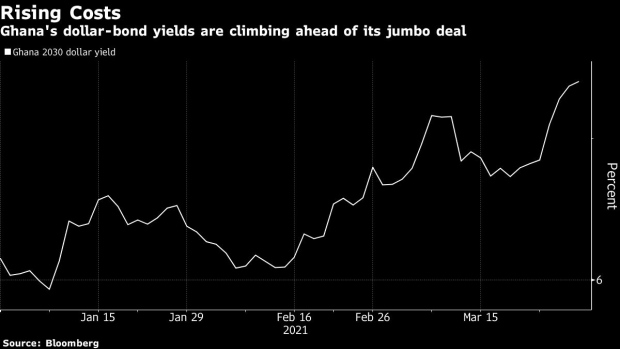

Yields on the country’s $1 billion of 2030 bonds climbed two basis points to 6.77% at 1:24 p.m. in London Monday, after rising 29 basis points last week.

“The zero-coupon bond is both novel and ambitious,” Mohammed Elmi, a portfolio manager at Federated Hermes Inc., said in an email. “It allows the sovereign to free up resources to spend on development expenditure, healthcare and education.”

Ghana is planning to use $1.5 billion of the proceeds of the four-part deal to help finance the 2021 budget, and will use the rest to roll over or buy back domestic and international bonds. Initial price guidance is around 9.5% for the 20-year tranche, 9% for the 12-year securities and 8% for the seven-year bonds, according to people familiar with the deal, who asked not to be identified because they can’t speak publicly. Guidance for the four-year zero-coupon bond is in the mid-70 cents range.

“Whether the zero is a good deal for Ghana will depend on the yield implied in the discount,” said Stephen Bailey-Smith, a Kolding, Denmark-based investment strategist at Global Evolution. “What it does is free up government cash flow in the short-term, but it makes the amortization lumpy.”

©2021 Bloomberg L.P.

Published at Mon, 29 Mar 2021 13:18:18 +0000

Comments

Loading…